Not known Details About Mileagewise - Reconstructing Mileage Logs

Not known Details About Mileagewise - Reconstructing Mileage Logs

Blog Article

A Biased View of Mileagewise - Reconstructing Mileage Logs

Table of Contents10 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown4 Simple Techniques For Mileagewise - Reconstructing Mileage LogsOur Mileagewise - Reconstructing Mileage Logs PDFsMileagewise - Reconstructing Mileage Logs Can Be Fun For EveryoneA Biased View of Mileagewise - Reconstructing Mileage Logs5 Simple Techniques For Mileagewise - Reconstructing Mileage LogsExcitement About Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance function recommends the shortest driving course to your workers' destination. This attribute enhances performance and adds to set you back savings, making it a crucial asset for services with a mobile labor force.Such a strategy to reporting and compliance streamlines the often complicated job of managing mileage expenditures. There are lots of benefits associated with utilizing Timeero to keep an eye on gas mileage. Let's have a look at several of the app's most remarkable attributes. With a trusted mileage monitoring device, like Timeero there is no demand to fret about accidentally leaving out a day or item of info on timesheets when tax obligation time comes.

The 5-Minute Rule for Mileagewise - Reconstructing Mileage Logs

With these devices in operation, there will certainly be no under-the-radar detours to boost your compensation expenses. Timestamps can be located on each mileage access, boosting credibility. These added confirmation measures will maintain the internal revenue service from having a reason to object your mileage documents. With accurate mileage monitoring innovation, your workers don't have to make rough mileage quotes and even stress over mileage expenditure tracking.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all automobile expenditures (mileage log). You will require to proceed tracking mileage for work also if you're using the actual expenditure technique. Keeping mileage records is the only way to different business and personal miles and offer the evidence to the IRS

Many gas mileage trackers allow you log your journeys manually while computing the distance and compensation amounts for you. Several also come with real-time trip monitoring - you require to begin the app at the start of your trip and stop it when you reach your final destination. These apps log your beginning and end addresses, and time stamps, along with the complete range and repayment amount.

See This Report on Mileagewise - Reconstructing Mileage Logs

Among the concerns that The IRS states that vehicle costs can be thought about as an "common and essential" price during working. This consists of expenses such as gas, upkeep, insurance coverage, and the lorry's depreciation. For these costs to be thought about insurance deductible, the lorry must be used for company functions.

All About Mileagewise - Reconstructing Mileage Logs

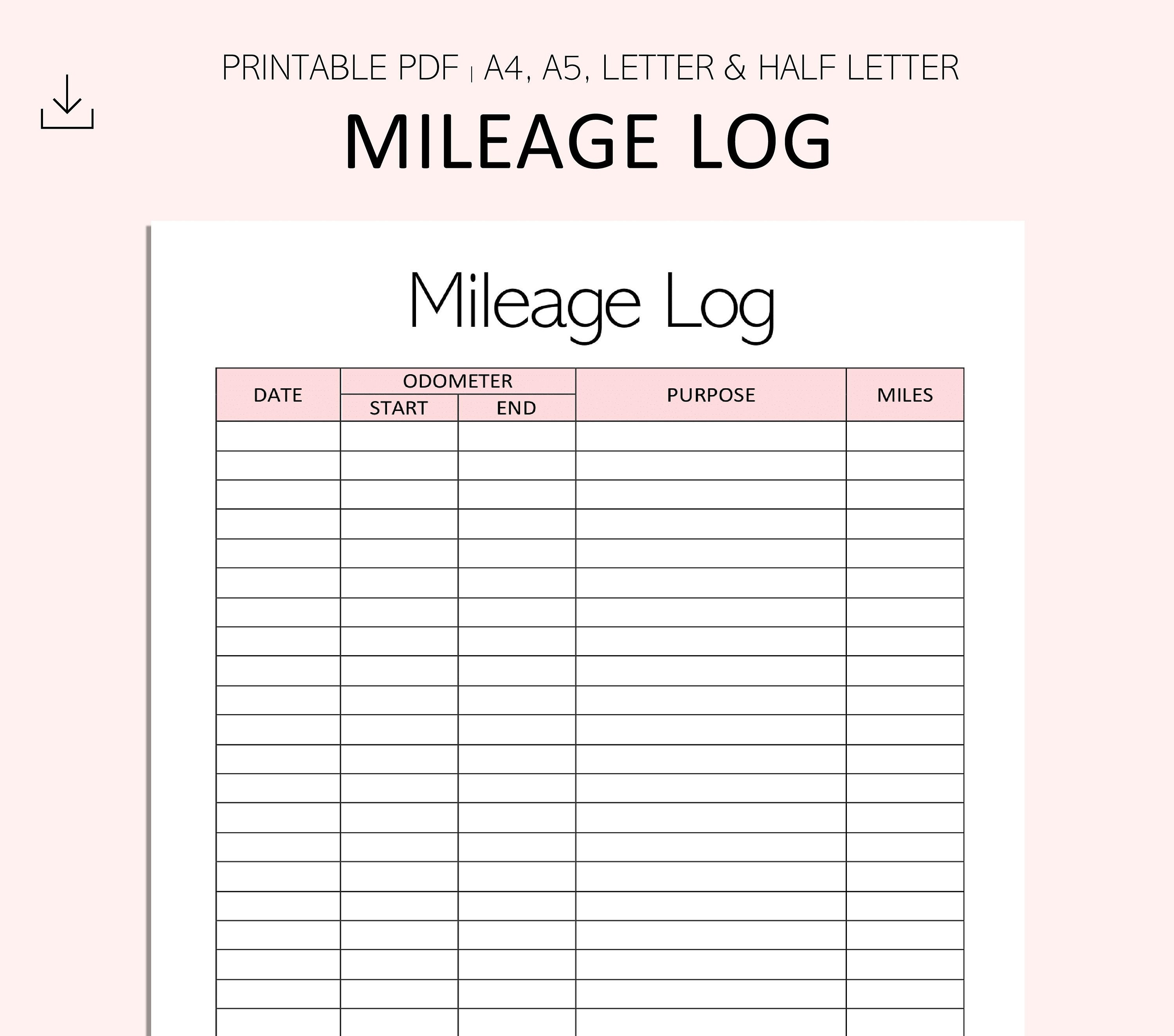

Start by taping your automobile's odometer analysis on January first and then again at the end of the year. In in between, diligently track all your company journeys writing the beginning and finishing readings. For each trip, record the area and organization objective. This can be simplified by maintaining a driving log in your cars and truck.

This consists of the complete business gas mileage and complete mileage accumulation for the year (company + personal), journey's date, location, and purpose. It's important to videotape tasks without delay and keep a simultaneous driving log detailing date, miles driven, and business function. Here's just how you can enhance record-keeping for audit objectives: Beginning with making certain a thorough gas mileage log for all business-related travel.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

The actual expenses approach is an alternate to the standard gas mileage rate technique. Rather than calculating your deduction based upon an established price per mile, the real expenditures method permits you to deduct the real costs associated with using your lorry for company purposes - mileage log for taxes. These prices consist of fuel, upkeep, repair work, insurance policy, depreciation, and various other related expenses

Those with significant vehicle-related expenses or distinct conditions may profit from the actual expenses technique. Please note electing S-corp status can transform this calculation. Eventually, your picked method must line up with your details economic objectives and tax obligation situation. The Criterion Gas Mileage Rate is a procedure issued yearly by the internal revenue service to identify the insurance deductible prices of running an auto for business.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

(https://www.tumblr.com/mi1eagewise/767691833835929600/mileagewise-is-an-international-organization?source=share)Calculate your overall organization miles by using your beginning and end odometer analyses, and your taped service miles. Properly tracking your specific mileage for company journeys aids in substantiating your tax deduction, particularly if you decide for the Criterion Gas mileage technique.

Keeping track of your mileage manually can call for persistance, however remember, it can conserve you money on your tax obligations. Record the overall mileage driven.

See This Report on Mileagewise - Reconstructing Mileage Logs

And now nearly every person makes use of General practitioners to obtain about. That suggests virtually everybody can be tracked as they go regarding their business.

Report this page